what happens to irs debt after 10 years

Can IRS debt be forgiven after 10 years. After that the debt is wiped clean from its books and the IRS writes it off.

Federal Net Interest Costs A Primer Congressional Budget Office

Life happens and unfortunately financial troubles can occur.

. If you have an outstanding tax debt there are things you should know. Many people feel tempted to wait out the 10 years to not pay the debt. After this 10-year period or statute.

The 10 years starts at the debt of assessment. To accomplish this on. After that time has expired the obligation is entirely wiped clean and removed.

If this is the first time youve owed the IRS money you can request a first-time abatement. If you owe money to the IRS due to unpaid taxes you wont have to pay it after the collection period has passed. The IRS has a decade to collect a liability from the date of assessment.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. Generally speaking the Internal Revenue Service has a maximum of ten years to collect on unpaid taxes. After 10 years the IRS can write the debt off and clear it from their books.

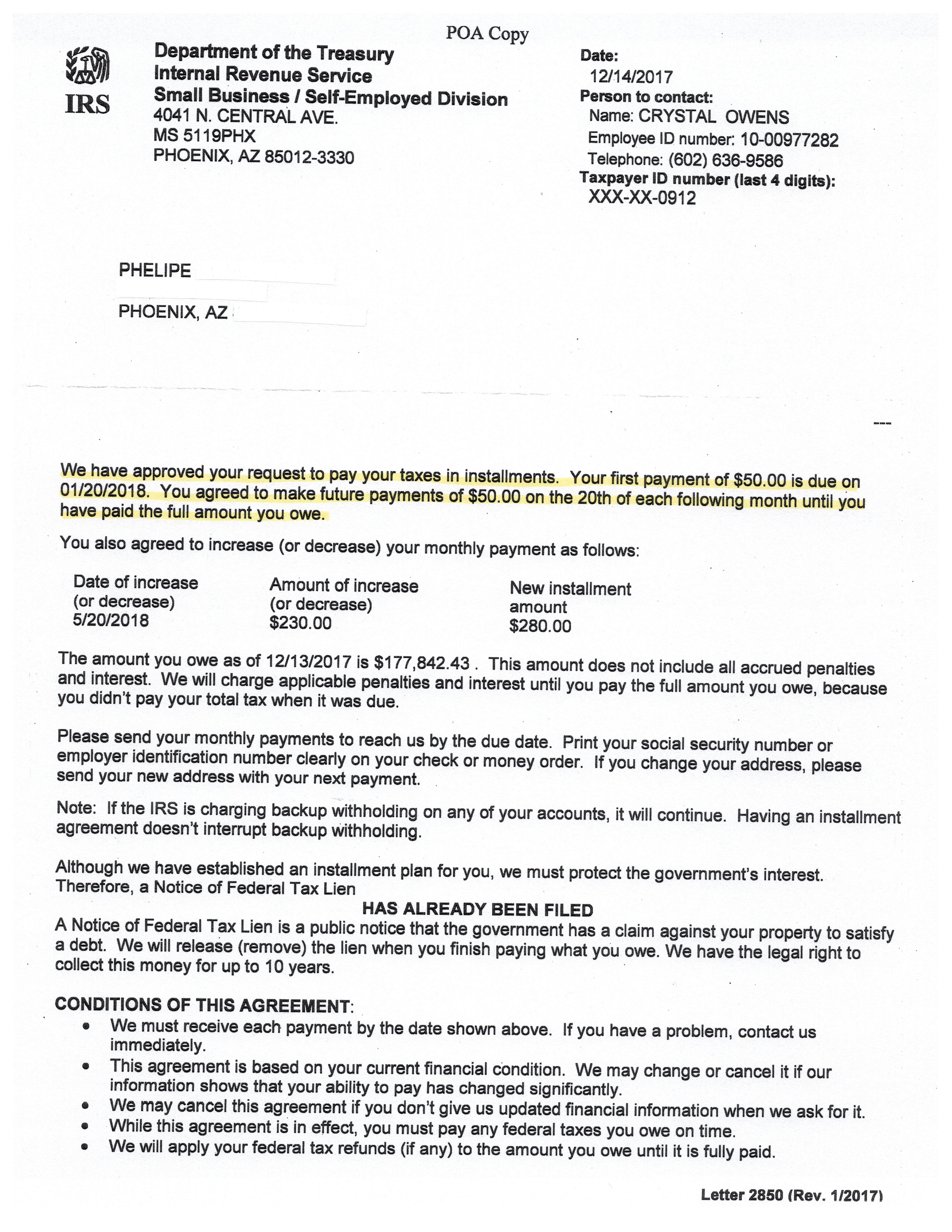

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt. Specifically Internal Revenue Code 6502 Collection After Assessment limits the IRS to 10 years to collect a tax debt.

In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. The IRS cant try and collect on an IRS balance due. A conviction happens in COURT A denied security clearance will have a negative impact in your career and will put you at a disadvantage for advancement and promotions 18 Obama.

What happens after 10 years of owing the IRS. Unfortunately that 10-year timeline. If you prove to the IRS this is the first time you have been in a.

If you prove to the IRS. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After that the debt is wiped clean from its books and the IRS writes it off.

However the waiting it out strategy is. Yes your IRS debt will be forgiven after ten years. What happens to a federal tax lien after 10 years.

It would help if. After this 10-year period or statute of limitations has expired the IRS can no longer try and collect on an IRS balance due. What happens after 10 years of owing the IRS.

Is unpaid tax debt stressing you out. After that the debt is wiped clean from its books and the IRS. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

After that the debt is wiped clean from its books and the IRS. Is IRS debt forgiven after 10 years. Does IRS forgive debt after 10 years.

After the 10 year statute of limitations on collections expires the IRS is required to release the lien.

Fy 21 22 Budget News 1 56 Tax Increase Orange Town News

The Economic Effects Of Waiting To Stabilize Federal Debt Congressional Budget Office

Does The Irs Forgive Tax Debt After 10 Years

The Top 10 Consequences Of Tax Debt H R Block

Does The Irs Forgive Tax Debt After 10 Years

See How Average Student Loan Debt Has Changed In 10 Years

The Tax Help Guide Ultimate Resource For Tax Help Questions

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Learn More About The Statute Of Limitations Http Ow Ly Fdl550ghxq8 Or Get A Consultation Today At 949 260 4770 Consultation Tax By Landmark Tax Group Facebook

Tax Debt Relief Irs Programs Signs Of A Scam

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Irs Taxes And Tips Mccauley Law Offices Blog

Does The Irs Forgive Tax Debt After 10 Years Sort Of Tax Attorney Explains Expiring Tax Debts Youtube

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Expats And Irs Tax Collection Statute Limitations

The Tax Cuts And Jobs Act Made The Debt Worse And Makes Fixing It Even Harder American Enterprise Institute Aei

A Blueprint For New Beginnings Iii Overview Of The President S 10 Year Budget Plan