coinbase pro taxes uk

Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP. Easy safe and secure Join 103 million customers.

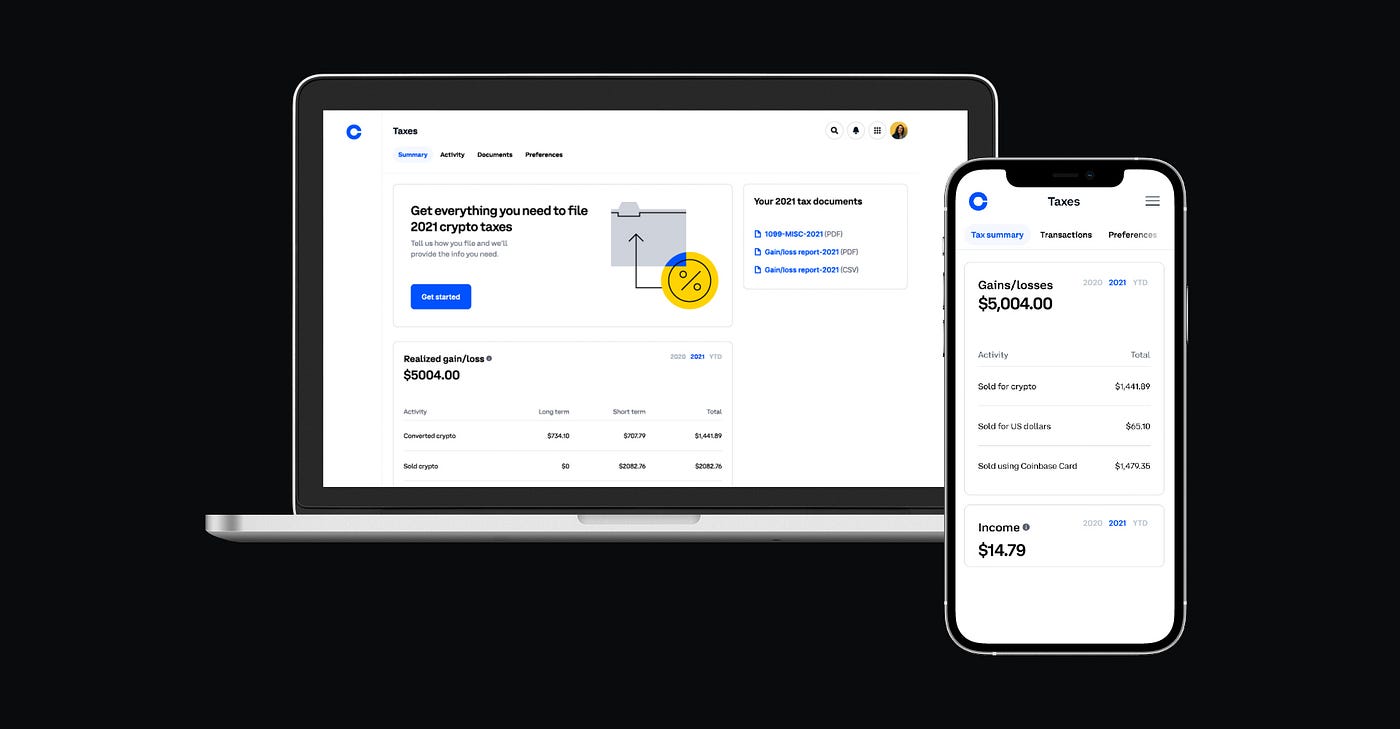

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

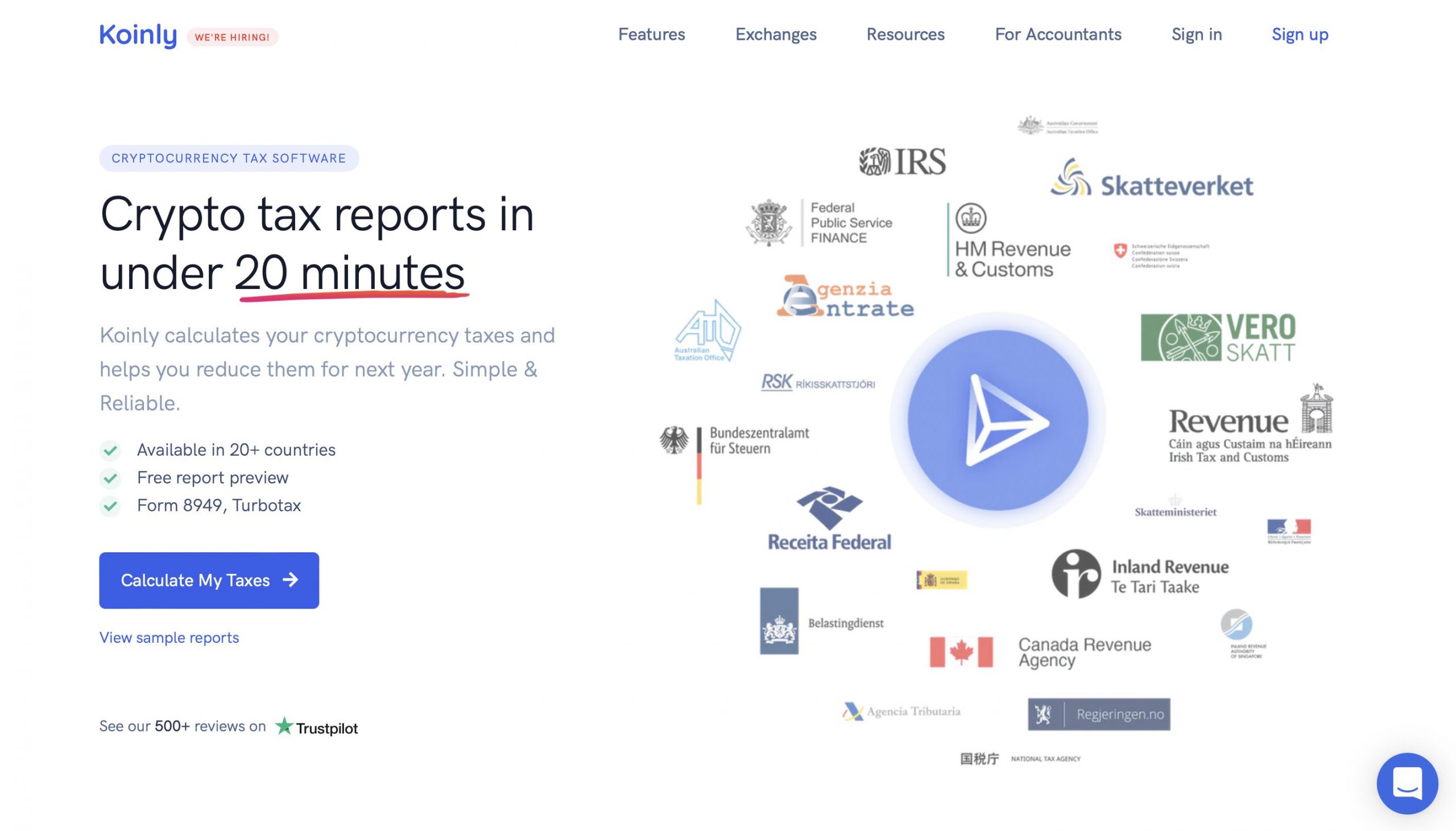

Koinly supports tax calculation for many countries such as the US UK Canada Australia and many other countries.

. The tax reporting feature on the other hand costs between 49 and 279 per year depending on how many crypto trades you did. Coinbase Pro operates a maker-taker model on deposits and withdrawals where fees are assessed as a percentage of the quoted currency. Trade Bitcoin BTC Ethereum ETH and more for USD EUR and GBP.

To place a trade on the mobile app open the app log in and do. Coinbase is the most trusted place for crypto in United Kingdom. But when it comes time to.

Following are two options. At the time of writing the platform supports. You can generate your gains losses and income tax reports from your Coinbase Pro investing activity by connecting your account with CoinLedger.

Select Cash out from the GBP balance. Do you have to pay taxes on Coinbase. To do this log in to your Coinbase Pro account and select statements from.

Do i need to report this to. Coinbase Pro is the best place to trade digital currency Industry leading API Our Websocket feed lets you easily gain access to real-time market data while our trading API lets you develop. United Kingdom Buy sell and convert cryptocurrency on Coinbase.

Coinbase will provide the UK tax authority with details of customers with a UK address who received more than 5000 worth of crypto assets on the Coinbase platform. Have used ONLY Coinbase If you have just traded ONLY on Coinbase you can use their tax center and download tax form which can be used to upload. If you are a Coinbase Pro customer and you meet their thresholds of more than 200 transactions and 20000 in gross proceeds then you will receive the IRS Form 1099-K instead.

The Coinbase cryptocurrency platform is getting ready to send over details of some of its United Kingdom-based customers to the Tax Authority in the country. For instance in the event that you obtained 01 Bitcoin for 1000 in April of 2018 and at that point sold it two months after the fact for 2000 you have a 1000 capital. As we mentioned above - if youre using Coinbase Pro youll need to generate a Coinbase Pro CSV export separately.

To cash out GBP from your Coinbase account follow these steps. Easily deposit funds via Coinbase bank transfer wire transfer or cryptocurrency wallet. Select the UK bank account you.

Select Assets on the menu at the top of the page. Check the table below for all supported countries. Coinbase Pro features advanced charting features and a huge range of crypto trading pairs - making it an ideal exchange for more experienced crypto traders.

Using this app you can access the Coinbase Pro trading terminal view your portfolio and transfer funds. Users of the Coinbase exchange. This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost basis specification strategy.

Easily deposit funds via Coinbase bank transfer wire transfer or cryptocurrency wallet. Established in 2012 Coinbase is now one of the leading cryptocurrency exchange brokers in the world offering a simplistic platform from which to buy. Coinbase owners in the UK who have received more than 5000 6474 in cryptocurrency will have their details passed to the UKs tax authority HMRC according to an.

I racked up just about under 80 and cashed it out converted all the cryptos to stellar then withdrew it to my bank if i can remember was under 40 or so. If you made 600 in crypto by an exchange such as Coinbase the exchange is required to use Form 1099-MISC to report your transactions. The broker charges 0 in maker.

Coinbase Pro Tax Reporting.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

![]()

Using Turbotax Or Cointracker To Report On Cryptocurrency Coinbase Help

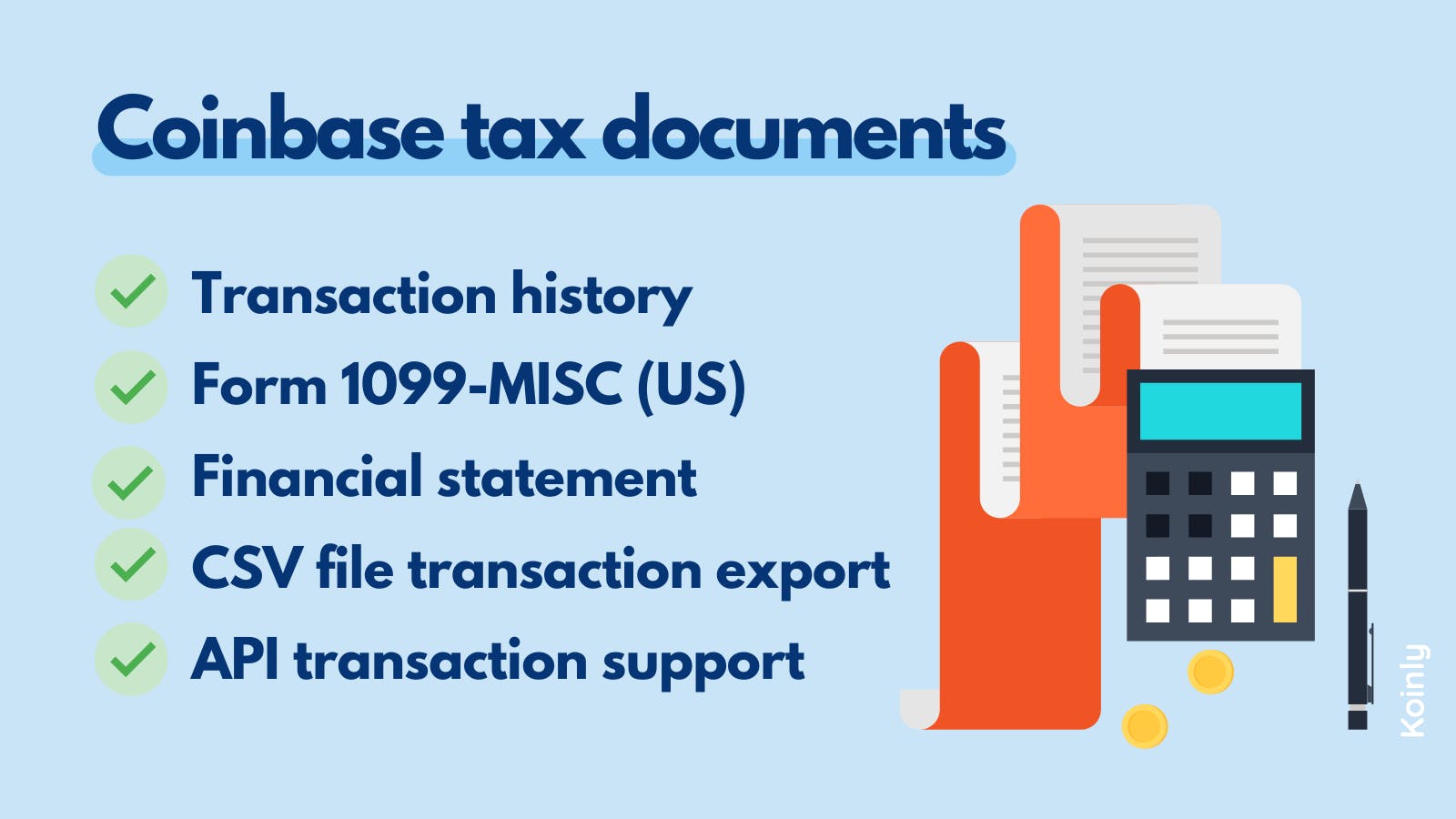

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

![]()

Uk Cryptocurrency Tax Guide Cointracker

Uk Cryptocurrency Tax Guide Cointracker

Coinbase Tax Documents In 2 Minutes 2022 R Cryptocurrency

Coinbase Debit Card Tax Guide Gordon Law Group

Coinbase Tax Documents In 2 Minutes 2022 R Cryptocurrency

Cost Basis What Is It And How It Can Help You Calculate Your Crypto Taxes Coinbase

The Complete Coinbase Tax Reporting Guide Koinly

Uk Cryptocurrency Tax Guide Cointracker

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

11 Best Crypto Tax Calculators To Check Out

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog